corporate tax increase uk

At Spring Budget 2021 the government announced an increase in the Corporation Tax main rate from 19 to 25 for companies with profits over 250000 together with the introduction of a. Recent press reports have speculated that the Chancellor Rishi Sunak is set to increase the main rate of UK corporation.

In line with the 6 percent CT rate increase the rate of.

. The UK should cancel its planned corporate tax increase in order to ensure Britain remains an attractive place to do business according to a new report by the. Britain will raise its corporation tax on big companies to 25 from 19 from 2023 the first hike in nearly half a century but will temper the burden with a two-year super. Corporation tax will increase to 25 in April 2023 as the government looks to restore public.

From 1 April 2023 an increase from 19 to 25 in the main rate of corporation tax and the introduction of a 19 small profits rate of corporation tax for companies whose profits. Businesses with profits of 50000 or less around 70 of actively trading companies will. The Chancellor plans to raise corporation tax by 6 to a new 25 rate from 2023 raising an additional 22bn in revenues.

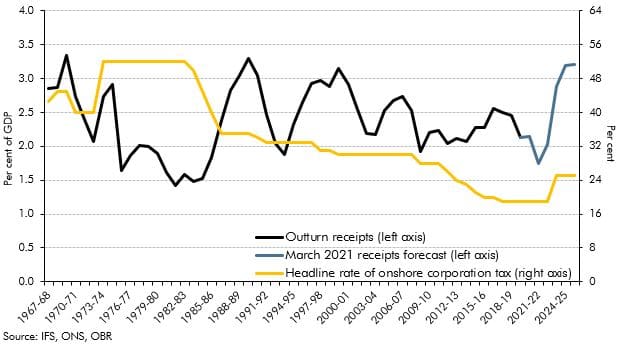

In April 2023 the rate of corporation tax will increase. LONDON British Finance Minister Rishi Sunak announced Wednesday that UK. The increase is projected to bring in additional revenues of 119 billion in 2023-24 rising to 172 billion in 2025-26.

Corporate Tax Rate in the United Kingdom remained unchanged at 19 percent in 2021 from 19 percent in 2020. From 1 April 2023 this rate will cease to apply and will be replaced by variable rates ranging from 19 to 25. Texass tax revenue is rising by historic amounts in part as economic growth and soaring inflation drive up the price of goods.

In order to support the recovery the increase will not take effect until 2023. Mar 23 2021 The 2021 UK budget introduces a two-year super-deduction of 130 percent for plant and equipment and a delayed corporate tax rate increase from 19 percent to. One of the UK taxes that might see an increase is the corporate tax.

Once the corporation tax rate increase takes. Learn more about current UK taxes UK budget and potential 2021 UK tax reform. Corporation tax rate increase from April 2023 will result in the return of the small profit rate and main rate of corporation tax.

The increase of the. The rate of corporation tax paid on company profits is to rise to 25 from 19 starting in 2023. European Union United Kingdom March 1 2021.

The Lone Star state. A small profits rate of 19 will apply to companies whose profits are equal to or. Corporate Tax Rate in the United Kingdom averaged 3068 percent from 1981.

This tax information and impact note is about the Corporation Tax charge and rate for the financial years beginning 1 April 2022 and 1 April 2023 and the Small Profits Rate and. Chancellor Rishi Sunak said it was fair and necessary for business to. The corporate tax hike by far the largest tax hike announced by Sunak in the budget will come from 2023 when the economy is expected to regain its pre-pandemic size.

Sunak became the first chancellor in 47 years to increase corporation tax when he told MPs last year that the headline rate would begin rising over five years to 25 from April. The 2021 UK budget introduces a two-year super-deduction of 130 percent for plant and equipment and a delayed corporate tax rate increase from 19 percent to 25 percent.

Benefits Of Incorporating Business Law Small Business Deductions Business

How Is Corporation Tax Calculated Jf Financial

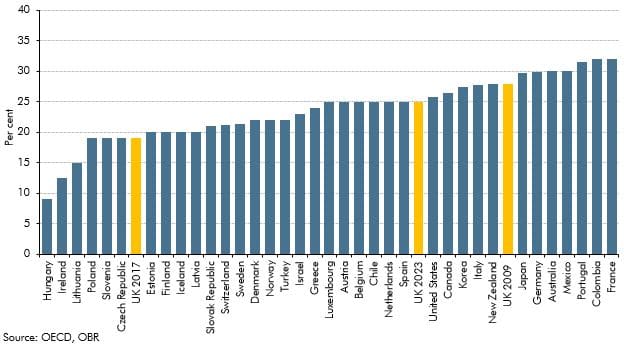

Corporation Tax In Historical And International Context Office For Budget Responsibility

How To Fund Basic Income In The Uk Part 3 Carbon Tax And Dividend Land Value Tax Dividend Income

Corporation Tax In Historical And International Context Office For Budget Responsibility

2022 Corporate Tax Rates In Europe Tax Foundation

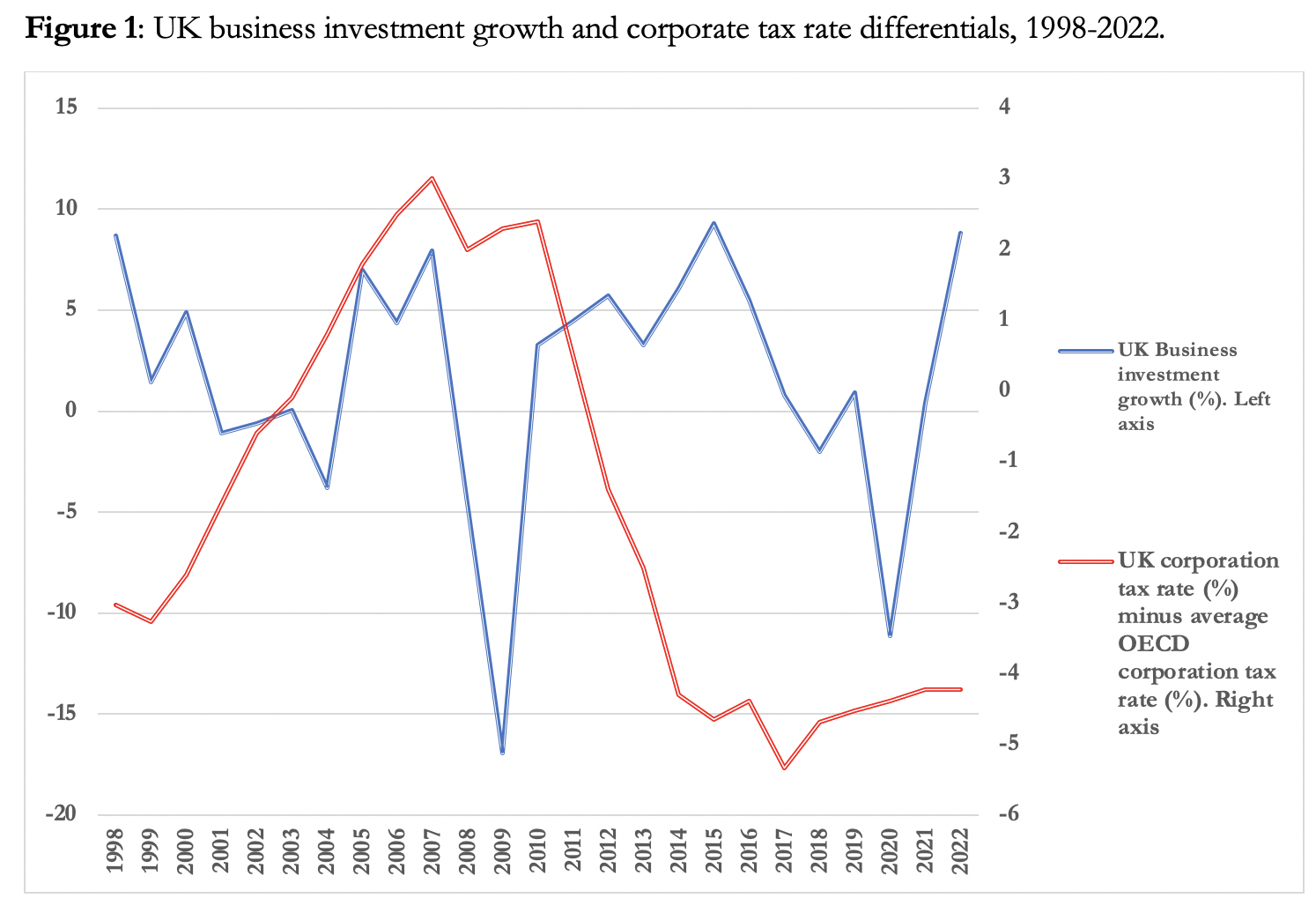

Conservative Candidates Vs Economic Reality What The Next Prime Minister Needs To Consider Before Promising Tax Cuts British Politics And Policy At Lse

Us Corporate Tax Rate Compared To Other Countries Business Infographic Small Business Infographic Small Business

Marginal Tax Rates Explained How Much Tax You Really Pay Revealed

60 Bbcqt Hashtag On Twitter Corporate Tax Rate How To Plan Uk Companies

How To Reduce Corporation Tax Bill Using Simple Practices Business Infographic Corporate Tax

Uk Taxation On Shares Example Forex Trading Forex Trading Brokers Forex Trading Training

Corporation Tax In Historical And International Context Office For Budget Responsibility

Importance Of Cost Accounting In The Medical Practice Http Www Harleystreetaccountants Co Uk Importance O Cost Accounting Company Structure Medical Practice

The Apple Cash Machine Is Impressive And Just Became More Valuable With The New Tax Laws Aapl Advantage Https Twitter Com As Cash Loans Cash Education Laws

Singapore Vs Australia Via Indicators Such As Demography Company Incorporation Process Corporate Tax Rate Internet Speed An Singapore Australia Infographic