tax deductions for high income earners 2019

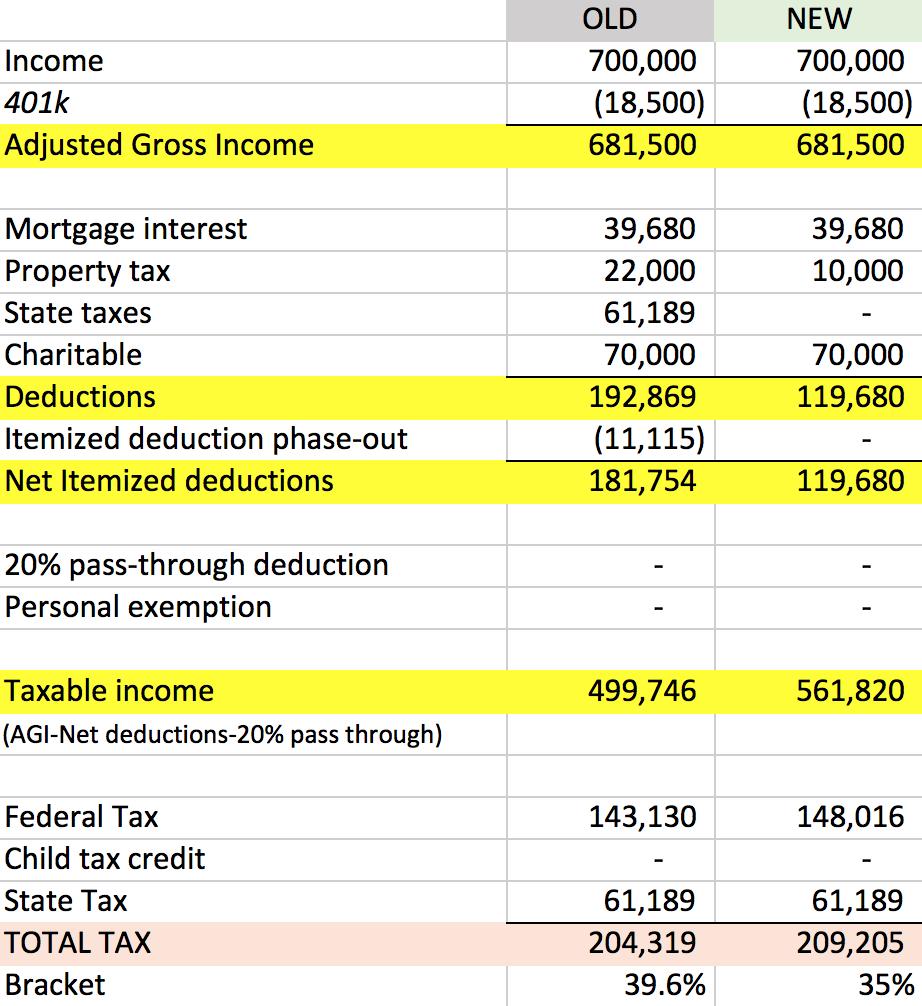

You may take an itemized deduction for contributions of money or property to a tax-qualified charity. The phase-out is 315000 for married couples.

Tax Strategies For High Income Earners Wiser Wealth Management

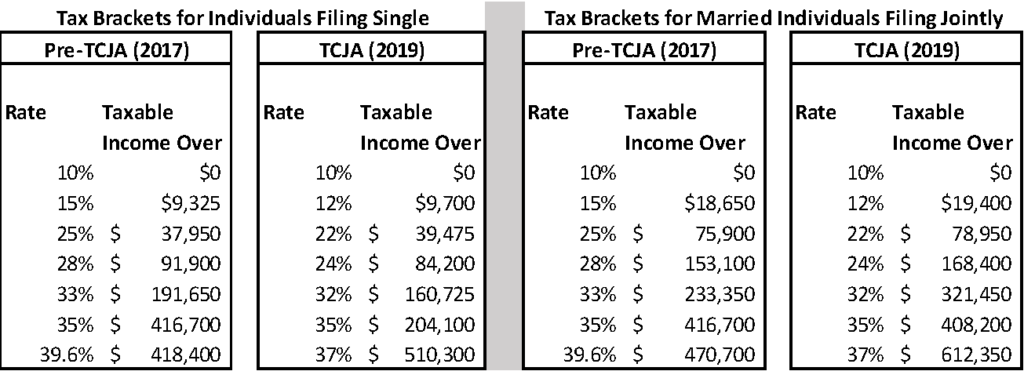

New tax legislation made small reductions to income tax rates for many individual tax brackets.

. In 2019 that rises to 6000 and 7000 respectively The limits for 401 ks are much higher. Single service business owners start getting that 20 phased out with a total taxable income over 157500. But lets say you earn more than the thresholds again thats 200000 for individuals 250000 for couples and 125000 for.

This means that many individuals may find it more beneficial to take. In the 10 tax bracket theyd save about 130. Here are 9 ways to accomplish your goal and reduce your tax bill.

Tax law changes in the Tax Cuts and Jobs Act affect almost everyone who itemized deductions on tax returns they filed in previous years. For self-employed individuals the accumulation is 20 of the annual income. For 2021 the max is 58000 and 64500 if you are 50 years old or older.

You can contribute an additional Rs50000 over the statutory deduction for. The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package includes several provisions that affect the high income earners retirement planning and tax planning strategies. On the other hand tax-deductible contribution limits to a Solo 401k are very high.

The usual rate is 10 of the subscribers monthly salary while it is 14 for government and bankers. The maximum tax-deductible contribution for a traditional IRA in 2022 is 6000 if youre younger than age 50. Learn More at AARP.

The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly. High-income earners may pay an additional 235 Medicare tax. In Georgia however the deduction is.

Check with a tax professional to find out more. Establish a donor-advised fund. 50 Best Ways to Reduce Taxes for High Income Earners.

If youre 50 or older the limit is 6500. Roth IRAs are incredibly attractive as they have tax-deferred growth and tax-free distributions in retirement. For 2018 the limit is.

Otherwise you pay 145 from each paycheck and your employer pays the other 145. For 2019 the employer and the worker each pay a 765 tax. But for many high earners they.

All individuals that own these types of businesses can qualify for this 20 t ax rate deduction however there are limitations if you own a service business. Both pieces of tax legislation drastically changed tax laws. Lets start with retirement accounts.

If youre self-employed you pay both the employer and employee portion and then deduct the employer portion on Form 1040. These include mortgage interest and property tax deductions and deductions for charitable contributions. The Tax Cuts and Jobs Act the tax reform legislation passed in.

If youre self-employed youll pay the full amount. But the tax changes are only temporary and increased the standard deduction for individual and joint filers alike. The good news is that with a combination of tax deductions tax credits and contribution strategies you can reduce your tax bill by reducing your taxable income.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. You can deduct up to 60 percent of your adjusted gross income each year for gifts of money. Max Out Your Retirement Contributions.

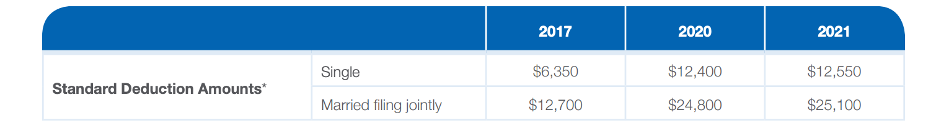

Borello Co we walk our clients through all of the tax challenges high-income earners face and help develop a tax and investment strategy to maximize wealth. The age for Required Minimum Distributions RMDs from retirement accounts was raised to 72. One of these changes is that TCJA nearly doubled the standard deduction for most taxpayers.

Contributions to a qualified retirement plan such as a traditional 401 k or 403 b. Contrast this to a worker earning 10200 per year. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Now in 2022 a higher standard deduction of 12950 for individuals and 25900 for joint filers make it harder for high-income earners to find enough deductions to itemize. In 2022 a higher standard deduction of 12950 for individuals and 25900 for joint filers makes it harder for high-income earners to. Your income places you in the 35 in the IRS 2022 tax bracket.

6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. Your tax savings will therefore be around 1400. The Medicare payroll tax is 29 which applies to earned income only.

For 2018 the maximum elective deferral by an employee. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. 21 hours agoMore than 32 of total federal student loan debt is held by households with incomes from about 107000 to 374000 the largest percentage of any income group according to the Education Data.

IRS Tax Reform Tax Tip 2019-28 March 21 2019. We saw a period of record-high government spending during COVID and this trend could continue. The contribution you will make.

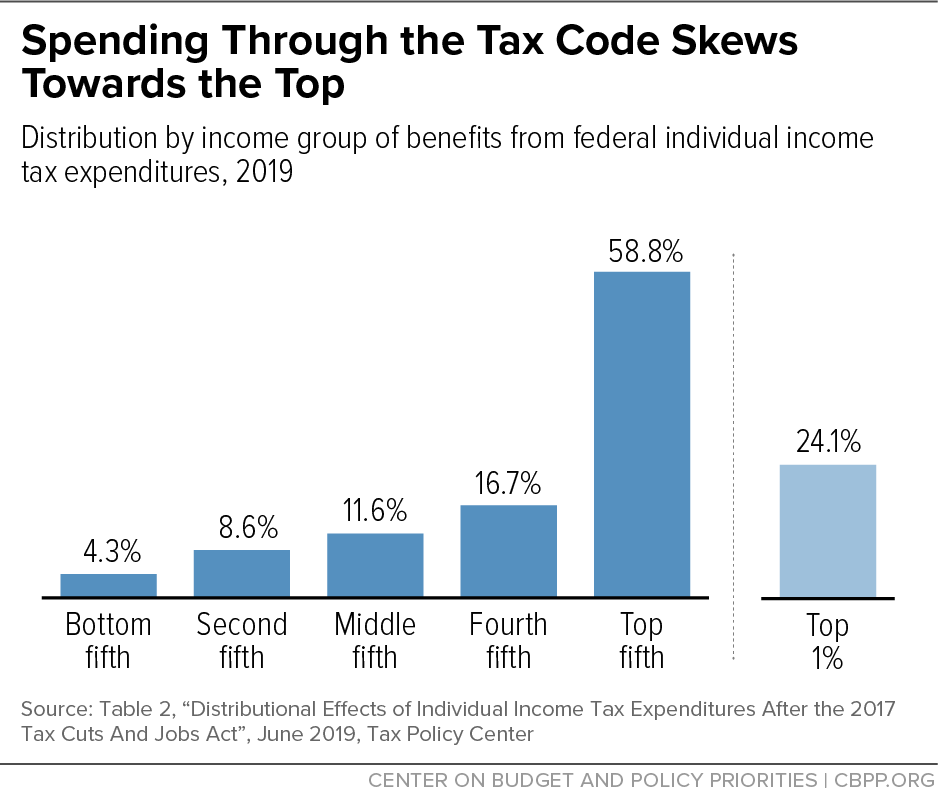

The benefit of credits and exemptions is also reduced as income rises. Theyre contributing 1300 to their retirement account. If youre charitably inclined charitable contributions can provide outstanding tax benefits.

The SECURE Act. WASHINGTON The Internal Revenue Service today urged high-income taxpayers and those with complex tax returns to check their withholding soon to avoid an unexpected tax bill or penalty when they file their 2018 federal income tax return in 2019.

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

The 4 Tax Strategies For High Income Earners You Should Bookmark

Which States Allow Deductions For Federal Income Taxes Paid Itep

Tax Strategies For High Income Earners Wiser Wealth Management

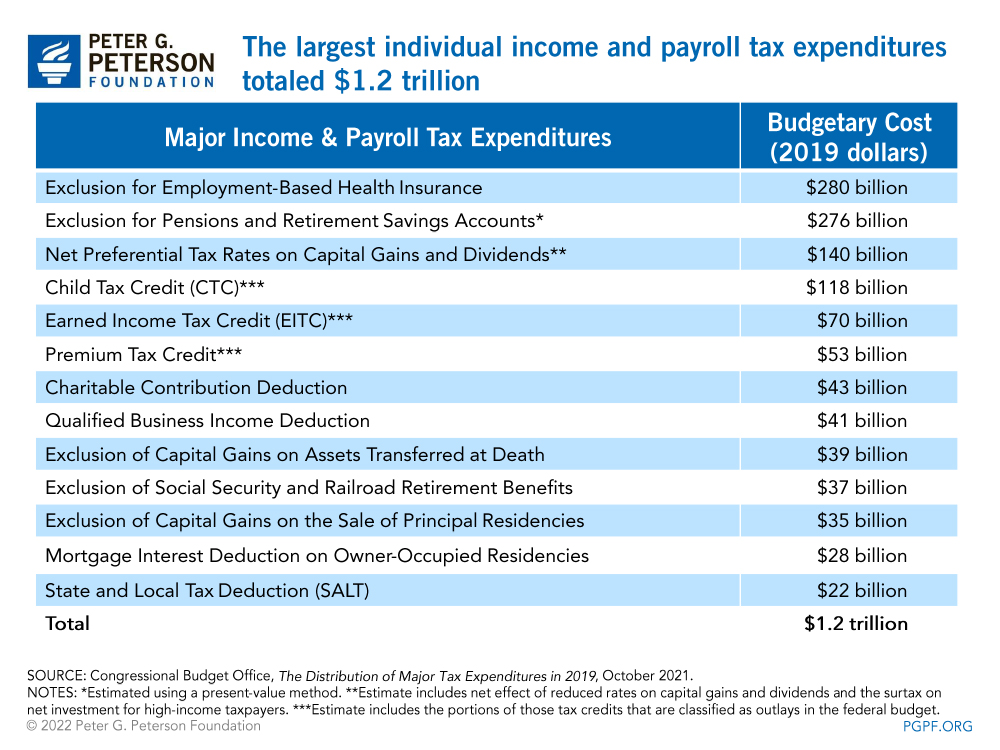

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

How The Tcja Tax Law Affects Your Personal Finances

How To Reduce Taxable Income For High Income Earners In 2021

Tax Strategies For High Income Earners Wiser Wealth Management

The New Year Is In Full Swing Know Your Limits And Get Ready To File Sensible Financial Planning

Who Pays Income Taxes Tax Year 2019 Foundation National Taxpayers Union

How The Tcja Tax Law Affects Your Personal Finances

How Do Marginal Income Tax Rates Work And What If We Increased Them

How The New Tax Plan Affects The High Income Physician Passive Income M D

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Who Benefits More From Tax Breaks High Or Low Income Earners

Who Benefits More From Tax Breaks High Or Low Income Earners

5 Outstanding Tax Strategies For High Income Earners